What Is Zero Rated Vat In Ksa

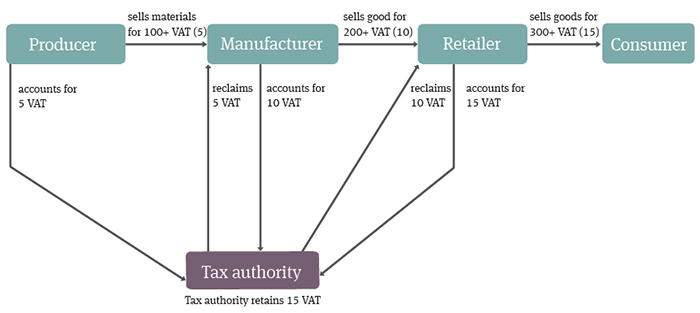

Box 3 Zero-rated domestic sales Amount. In our article VAT rates in Saudi Arabia we have learnt about the various types of VAT rates applicable to supply of goods and services in KSA.

Introduction Of Vat In Oman Wts Global

The following supplies are deemed zero-rated and therefore eligible for reclaiming VAT suffered.

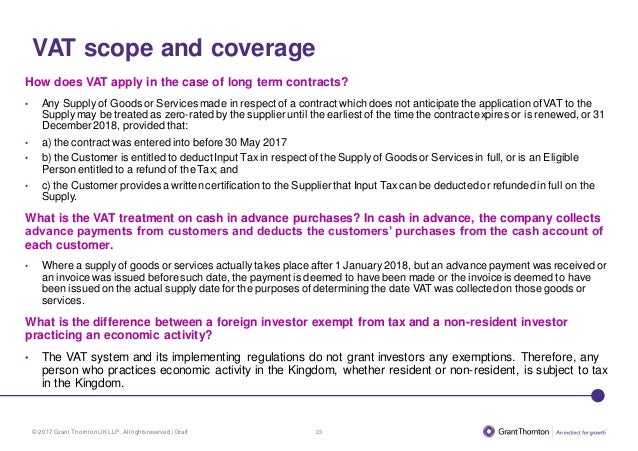

What is zero rated vat in ksa. Zero-Rated VAT includes goods and services that are VAT taxable but at the rate of 0. While being required to either exempt or zero-rate other. In KSA in particular the law requires suppliers to assess a number of factors prior to zero-rating services.

To qualify for zero. The value of all goods and services subject to 0 VAT sold in the KSA during the current filing period will appear under this box. However in accordance with the GCC VAT treaty and Article 10 of the KSA VAT law certain goods and services will be subject to zero rate or will be exempted from the VAT.

VAT is all set to be implemented in across GCC from January 2018. Governments commonly lower the tax burden on low-income households by zero rating essential goods such as food and utilities or prescription drugs. One such measure was an increase in the VAT rate to 15 that would be.

Exports outside the country under the GCC VAT Law are zero-rated. The standard VAT rate is 5. Article 33 of the KSA VAT Implementing Regulations set out the conditions in which services can be subject to the zero rate of VAT.

It means that you have to keep a record of them and report them on VAT return even if the rate is 0. GCC VAT agreement allows implementing member states to Zero rate of international transportation of goods and passengers. This reduces the price of a good.

Exports of goods or services outside the Council Territory backed by evidence of the movement of the goodsservices Supplies within customs duty suspension zones. Zero-rated goods and services include. In principle both UAE and KSA have adopted this in their local legislation.

For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. Based on Saudi Arabias draft VAT implementing regulations where education and healthcare services are neither exempt or zero rated education and healthcare providers will generally be subject to VAT at the standard rate with public education. VAT on food items zero rated makes up approximately R23 billion thereof or roughly 41 per cent equating to approximately a 1 increase in the VAT rate.

On 11 May 2020 the Government of the Kingdom of Saudi Arabia KSA announced several measures to counter the financial and economic impact of COVID-19 on the government budget. Supplies can be taxable 5 taxable 0 or zero rate supplies exempt or out of scope of VAT. This will be determined in the KSA Draft VAT Implementing Regulations.

Businesses dealing with Zero-Rated goods and services can reclaim their input VAT as they are VAT registered companies in the UAE. The KSA introduced VAT with effect from 1 January 2018 at a standard rate of 5 with specific limited zero-ratings and exemptions. Registered businesses conducting economic activities subject to VAT whether standard rated or zero-rated are entitled to deduct input tax whereas registered businesses conducting VAT-exempted economic activities are not entitled to deduct these amounts.

Zero-rated supply Zero-rated goods and services are legally taxable but are taxed at a VAT rate of 0. Within the scope of VAT will generally be charged at a standard rate of 5 unless the goods or services are exempt or zero-rated. The Member States have been granted the flexibility to choose whether the supply of specific goods or services are considered treated as zero-rate or exempt.

The KSA is the first of the Gulf Cooperation Council GCC States to step away from the originally agreed GCC standard rate of 5. Intra-GCC transactions are the transactions sales and purchases between member states of GCC. Bahrain Kuwait Oman Qatar Saudi Arabia and UAE have signed the GCC VAT Agreement.

The Saudi General Authority of Zakat and Tax GAZT has issued a release that clarifies the value added tax VAT zero-rating and exemptions for select goods and services as provided in the implementing regulations for Saudi Arabias new VAT regime which will be introduced on 1 January 2018.

Vat Changes In 2020 What You Need To Know Eca International

Vat Return Filing Gazt Value Added Tax

Zero Rated And Exempt Goods Services In Uae Vat Youtube

How To Understand And Manage Vat For Your Business

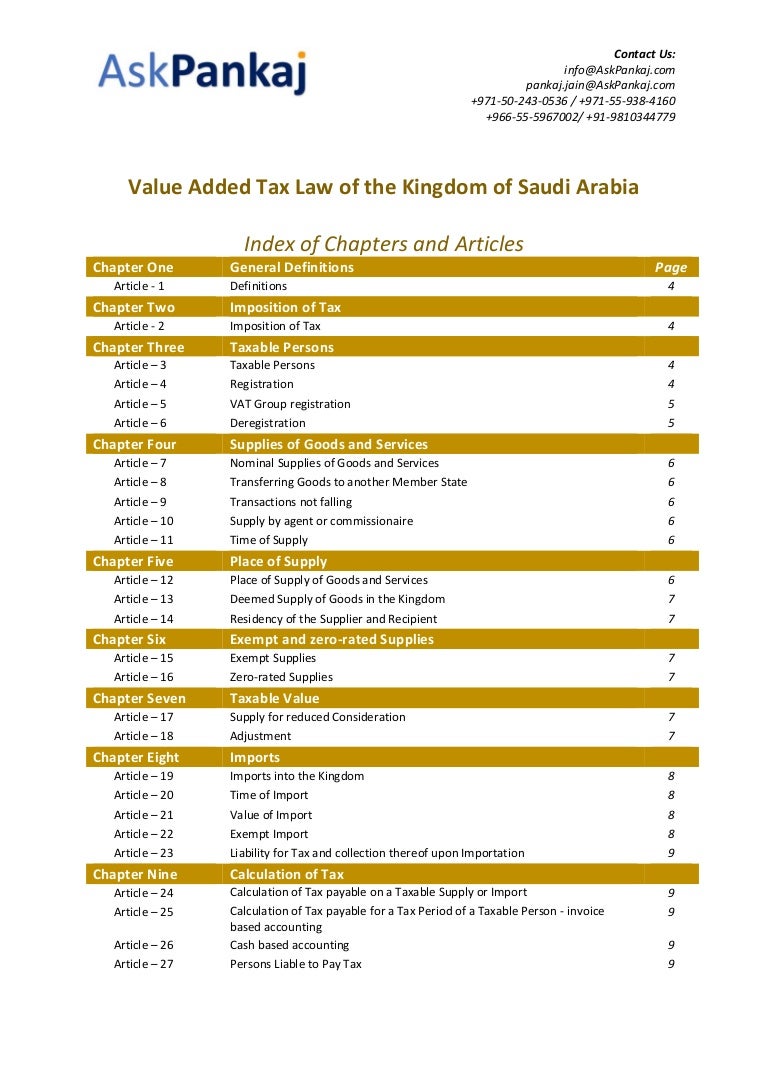

Kingdom Of Saudi Arabia Ksa Value Added Tax Vat Law With Index

Vat In The Uae Implications For Transactions And Group Structuring Global Law Firm Norton Rose Fulbright

Saudi Arabia Vat Frequently Asked Questions

Enable Inventory Features In Tally Erp 9 Software Management Information Systems Best Accounting Software Accounting Services

Learn How To Create A Payment Voucher With Voucher Class In Tally Payment Voucher Learning Class

What Is Saudi Vat And The Rates Applicable In The Kingdom A Short Explanation

Vat Return Filing Gazt Value Added Tax

Vat Return Filing Gazt Value Added Tax

Vat In Uae What Are Zero Rated Supplies Under Vat Vat In Uae Uae Supplies

17 Interjurisdictional Issues In The Modern Vat

Import Of Goods And Services Under Gcc Vat Goods And Services Management Information Systems Best Accounting Software

Vat In Uae What Are Zero Rated Supplies Under Vat Vat In Uae Uae Supplies

Value Added Tax Vat In Saudi Arabia Guide 2021 Protaxprotax

More Clarity Needed For Vat On Healthcare Education In Uae Health Care Healthcare Education Education

Post a Comment for "What Is Zero Rated Vat In Ksa"