How To Get Into Anti Money Laundering Jobs

You have to earn it. Browse 6501 ANTI MONEY LAUNDERING job 38K-115K listings hiring now from companies with openings.

Revised Central Bank Amla Guidelines Anti Money Laundering

A national consumer banking organization is looking for a highly analytical Anti-Money Laundering Specialist to join their team in Cincinnati Ohio for a 5-month project.

How to get into anti money laundering jobs. Luckily the ACAMS counts professional experience by awarding 10 credits per year for up to three total years or 30 credits. Policy roles often involve setting high level policies and. Earning a Certified Anti-Money Laundering Specialist CAMS credential will go a long way to opening doors.

For those looking to transition into an anti-money laundering role Austin suggests you consider taking the following steps. Certified Anti-Money Laundering Specialist Requirments The requirements candidates should have to take the CAM exam includes Firstly the aspirants need to earn at least 40 credits of college coursework. The benchmark Compliance qualification that is highly desired by employers is often the Certified Anti-Money Laundering Specialist CAMS course.

We are looking for someone with strong knowledge of banking operational policies procedures products and services. Anti-money laundering has been one of the dominant stories in financial services this year and the trend isnt likely to. Big Data Developer 4.

So how do you go about earning your CAMS. Those who want to become an anti-money laundering specialist will not need the right education or employment but a professional accreditation. Find your next job opportunity near you 1-Click Apply.

Roles include anti-bribery and corruption specialists fraud analysts and cyber security experts. Apply to Anti Money Laundering Analyst Anti Money Laundering Manager Compliance Officer and more. The Certified Anti-Money Laundering Specialist CAMS credential is the one-of-a-kind designation for financial auditors to combat money laundering.

If you do find that youre owed money sometimes the OT wage theft can get into the tens of thousands of dollars consider contacting an employment. This allows you to be a Certified Anti-Money Laundering Specialist. You have to prove yourself by registering for and taking the CAMS exam.

You can also establish your credibility as a suitable candidate for an AML role with an ICA qualification. APAC Wealth Manager 9. Anti-money laundering analysts.

Anti Money Laundering 217. BCMA Capital Markets 3. The American Banker Association runs a week-long compliance school in the autumn that is widely recognized.

One way is to thoroughly vet all job offers. Protecting yourself against shipping and money laundering scams can be done in a few simple yet effective ways. Anti Money Laundering Careers ICA Begin a career in AML Experience within a financial services firm will help you to start a career in AML.

Use UpDown Arrow keys to increase or decrease volume. Yeah sorry you dont just get CAMS. It can be hard to turn down a chance at having a new job but carefully evaluating the job offer can be the difference between keeping your information safe and exposing yourself to personal and financial risk.

Apply for BSAAML analyst positions at any number of financial institutions or if youre eligible apply for an internship opportunity that can lead to a role in that type of position. Consider Compliance contracting jobs temporary work. For senior-level roles passing the Series 24 Exam administered by the Financial Industry Regulatory Authority FINRA is a must.

However joining the organization isnt something you just do. There are a range of professional qualifications that you can undertake that will help you to get into the compliance field. Anti Money Laundering jobs now available.

The range of threats facing organisations means there are a multitude of career options in financial crime prevention. BCMA Investment Banking 20. Get your CAMS certification If you are not already a certified anti-money laundering specialist this should be step one toward a career in this field.

BCMA Corporate Banking 7. Be sure your LinkedIn profile is up to date looks professional and showcases your skills.

Anti Money Laundering Aml Compliance Protiviti United Kingdom

Red Hat Enterprise Open Source Anti Money Laundering Solution

Are You Ready For The 6th Aml Directive Enterprise Risk Management Software Businessforensics

Application Of Artificial Intelligence And Machine Learning To Anti Money Laundering

Anti Money Laundering What It Is And Why It Matters Sas

Aml Compliance Checklist Best Practices For Anti Money Laundering Money Laundering Compliance Human Resources

Know Your Customer And Anti Money Laundering Measures Ing

Anti Money Laundering Experts Call For More International Cooperation Europol

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

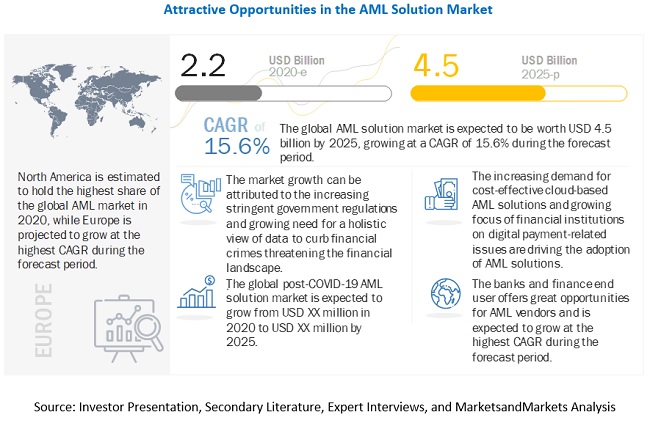

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Tech Must Fight 1 87 Trillion Aml Problem Growth Company Corporate Management Know Your Customer

Anti Money Laundering Overview Process And History

Anti Money Laundering In The Eu Ceps

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form

Do Anti Money Laundering Requirements Solve Fake Residency Concerns Tax Justice Network

Pakistan On Course To Finalize New Anti Money Laundering Law Anti Money Laundering Law Digital Currency Money Laundering

Certified Anti Money Laundering Professional Swiss School Of Business And Management Geneva

Post a Comment for "How To Get Into Anti Money Laundering Jobs"