Customer Risk Rating Aids In Determining

Risk ratings and scaling can show where additional resources are required. Risk rating analysis is the identification and evaluation of all risks.

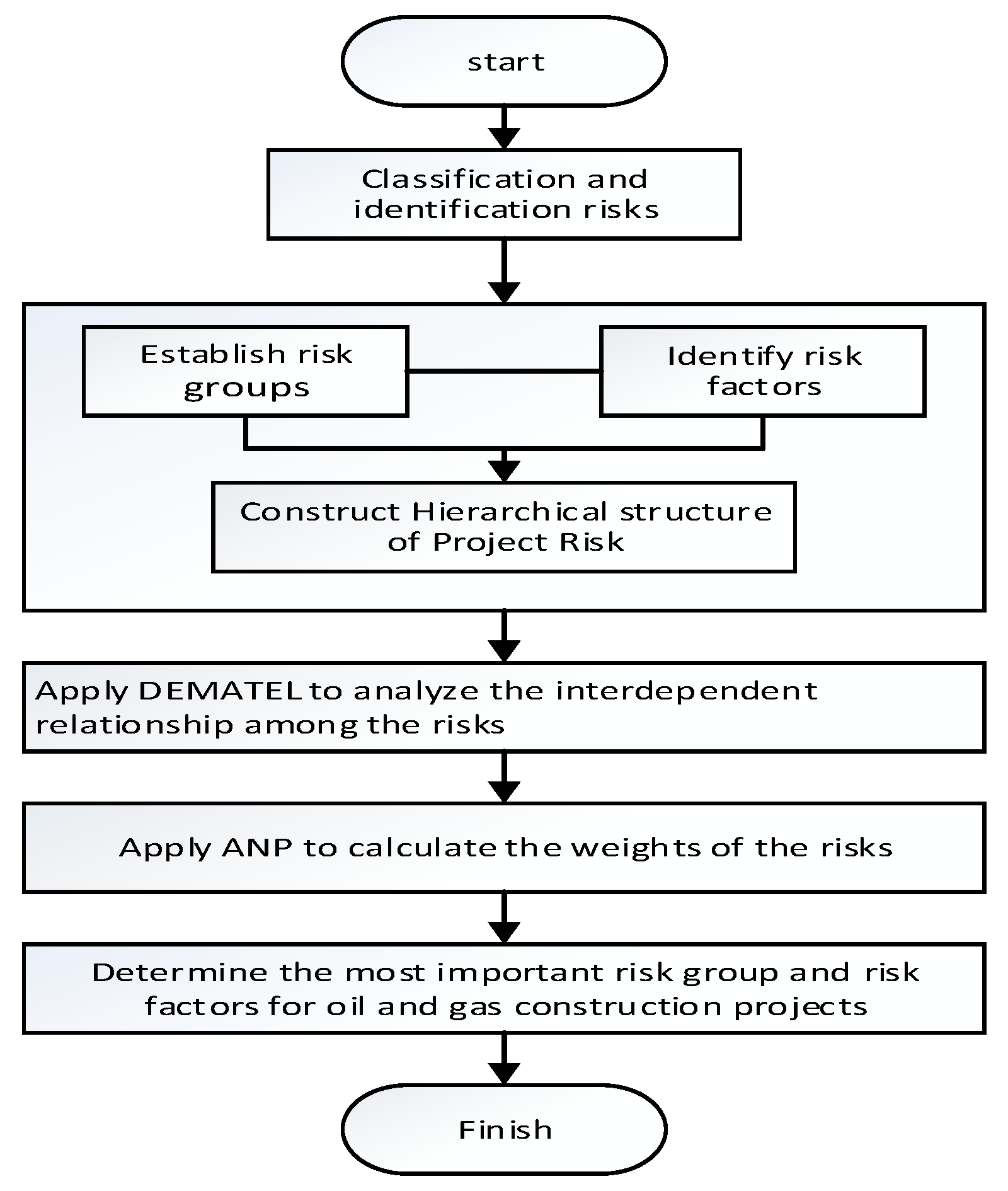

Sustainability Free Full Text Dematel Anp Risk Assessment In Oil And Gas Construction Projects Html

We obtain maximum likelihood estimates of the models parameters and we analyze the results of various hypothesis tests about specic parame-ters to determine if they have relevance to AML surveillance policies.

Customer risk rating aids in determining. This concept is also commonly referred to as the customer risk rating. Protect Your Business From Financial Crime and Reduce Risk With KYC Due Diligence. You can determine the risk of extending credit and quantify credit limits by using the five factors termed the five Cs of creditworthiness While there are no strict guidelines for how to weigh these Determining Customer Creditworthiness.

Jouw hulp is nodig. It must also take specific measures in addition to performing normal customer due diligence. Many risk management activities already take part across DFID but improvements need to be made to make these activities more visible and make the management of risk more explicit.

Onderzoek is van groot belang. Where any customer is rated as high risk EDD must be obtained. Learn More and Request Details.

Of a customer is with a business credit report to get their credit rating. On the customer risk rating methodology. Direct knowledge of customers credit needs and financial conditions.

AML KYC BSA risk assessment and rating is performed during the client onboarding phase and also throughout the life of the customer. Jouw hulp is nodig. Advertentie Iedereen verdient een kans.

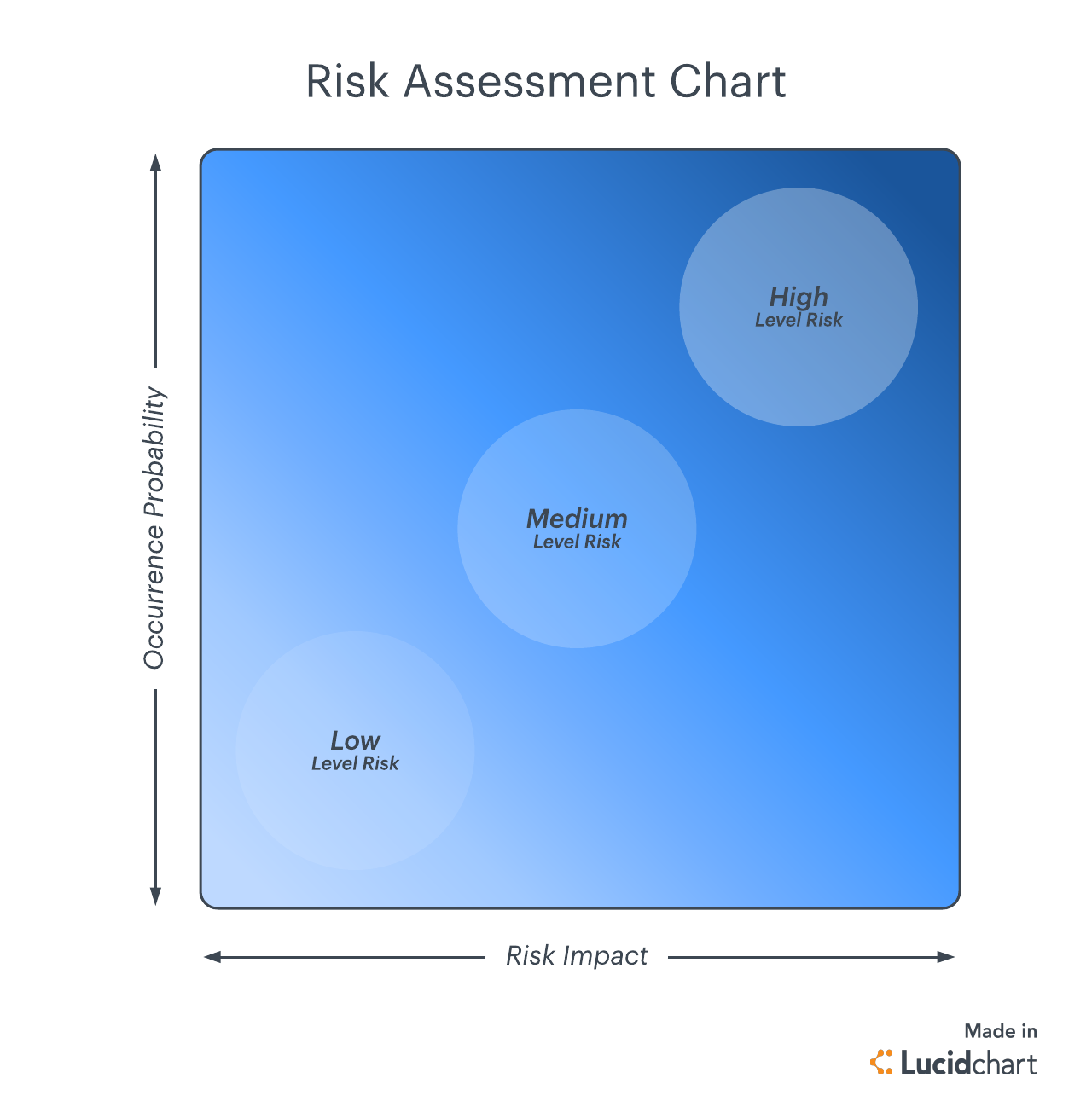

Rating Credit Risk Comptrollers Handbook April 2001 A-RCR A. In our discussion well focus on rating risks using probability of occurrence and severity of consequences scales. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account.

3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to 3in the rule as the customer risk profile. Know Your Customer - Risk Rating.

Any customer account may be used for. Know Your Customer KYC is the practice carried out by companies to verify the identity of their clients in compliance with legal requirements and current laws and regulations. 5 Ways to Cut Customer Risk A big customer win can be exhilarating.

Ratings are also useful in determining the appropriate amount of capital to absorb extraordinary unexpected credit losses. Risk Identification and Analysis 8. By Ed Powers Head of Capital Access Funds Bank of America.

Know Your Customer is the due diligence that Banks must perform to identify their clients and ascertain relevant information pertinent. Determining the potential money laundering risks posed by a customer will provide significant input into the overall money laundering risk assessment. Onderzoek is van groot belang.

Just make sure you dont put all your eggs in one basket. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. Advertentie Unlock A World Of Data-Driven Opportunities.

Because risk identification and rating establish priorities this assessment should be incorporated early in the experimental process. Customer Risk Profile. Each institution needs to assess based on its own criteria whether a particular customer poses a higher risk of money laundering and.

Based on the customers risk score the KYC system determines the next review date. Advertentie Iedereen verdient een kans. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community.

If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Within the FATF standards3 Recommendation 12 requires a reporting entity to have in place appropriate risk management systems to determine whether a customer or beneficial owner is a PEP. Literature to determine what situations truly represent risk.

To determine a customers overall risk rating a. The customer risk ratings data are described in the ensuing subsections. Considered in determining whether a customer may pose a higher risk which are derived from the AMLCFT Code.

It is for regulated entities to formulate their own risk policies and risk appetite. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score.

Summative Evaluation An Overview Sciencedirect Topics

Risk Acceptance Criterion An Overview Sciencedirect Topics

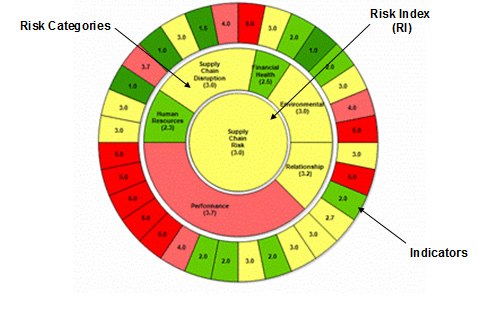

Supply Risk Assessment Iss Group

Methodology And Process For Development Of The Guideline Who Consolidated Guideline On Self Care Interventions For Health Ncbi Bookshelf

263 Questions With Answers In Risk Assessment Science Topic

Top Restaurant Cash Flow Hacks Every Restaurant Owner Should Know Positive Cash Flow Cash Flow Inventory Management Software

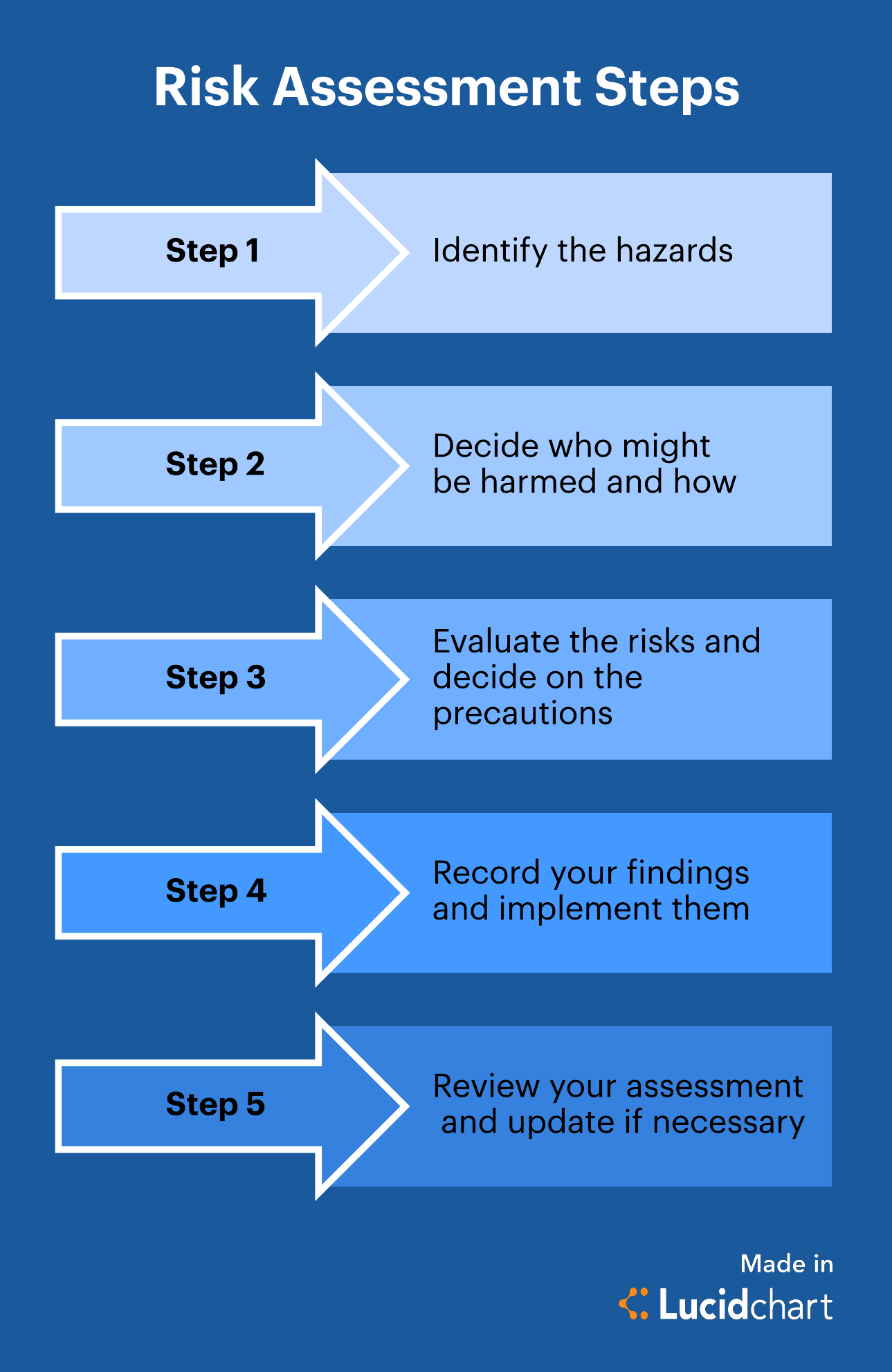

A Complete Guide To The Risk Assessment Process Lucidchart Blog

A Complete Guide To The Risk Assessment Process Lucidchart Blog

Sustainability Free Full Text Risk Management Framework For Handling And Storage Of Cargo At Major Ports In Malaysia Towards Port Sustainability Html

A Complete Guide To The Risk Assessment Process Lucidchart Blog

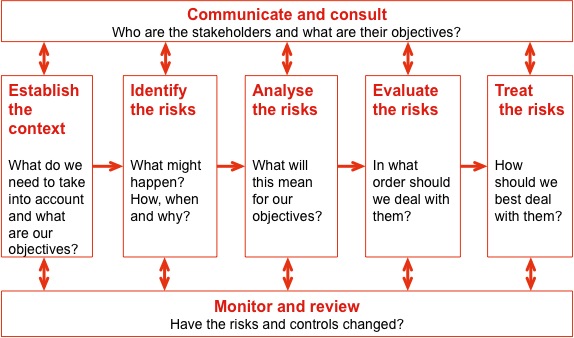

Risk Assessment And Risk Treatment Broadleaf

Microbiological Risk Assessment Quality Assurance Food Safety

Security Risk Analysis And Management An Overview 2013 Update

A Complete Guide To The Risk Assessment Process Lucidchart Blog

Chapter 3 Site Design And Stormwater Management Integration Philadelphia Water Stormwater Plan Review

5s Radar Chart Radar Chart Lean Six Sigma Change Management

Risk Acceptability An Overview Sciencedirect Topics

Https Checkpointlearning Thomsonreuters Com Courses Filedownload Courseidhiddenfield 2359 Deliveryformatidhiddenfield 5

Post a Comment for "Customer Risk Rating Aids In Determining"